When a new importer chooses a product to import, he must pay attention to import tariffs to ensure that it is a profitable purchase. In this article, you are going to present some common products, but they are grouped into the catalog of dumping products by customs and very high tariffs (antidumping tariffs) are going to be charged.

First, we must know the term "dumping" and "anti-dumping": If a company exports a product at a price lower than the price it normally charges in its own domestic market, it is said to be dumping the product. Customs impose antidumping and countervailing duties to offset the value of dumping and/or subsidies, thus leveling the playing field for domestic industries harmed by such unfairly traded imports. Below we see some products that are considered as dumping in Peru, Mexico and Colombia.

Peru: Footwear

Imports of all varieties of Chinese footwear with part made of natural leather (shoes, sneakers, boots, hiking boots, slippers and other footwear), as well as two varieties of Chinese footwear with upper parts made of rubber or plastic (slippers and other footwear); they will be subject to the payment of antidumping duties, regardless of the price they register when imported into Peru.

Taxes for importing footwear :

1. Tariff : 11% CIF

2. Anti-dumping taxes:

USD 26.33/ pair (value of shoes<$2.77);

US $ 20.47/ pair ($2.78<shoe value<$5.55);

USD14.62/ pair ($5.56<shoe value<$8.33);

USD 8.77/ pair ($8.34<shoe value<$11.11);

USD 2.92/ pair ($11.12<shoe value<$13.9);

3. IGV: 16% CIFD

4. Municipal tax: 2% CIFD

Weave fabrics, made exclusively from staple fibers of polyester and cotton, unbleached, white/bleached and dyed in one color, were also imposed provisional anti-dumping duties for several months. Importer is must be attentive to policy changes.

Mexico : Iron or steel products

Under pressure to stop Chinese imports that threatened important sectors of its manufacturing industry, Mexico imposed high levels of antidumping duties on iron or steel products, for example, steel tubes, often used for oil and gas pipelines. (HS CODE: 412xxxx)

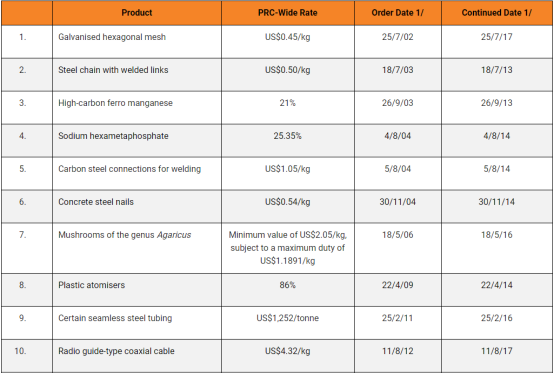

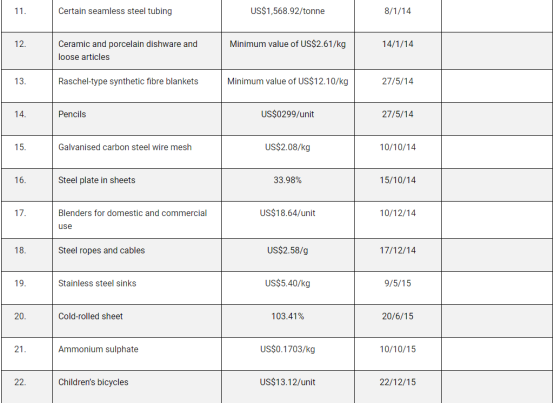

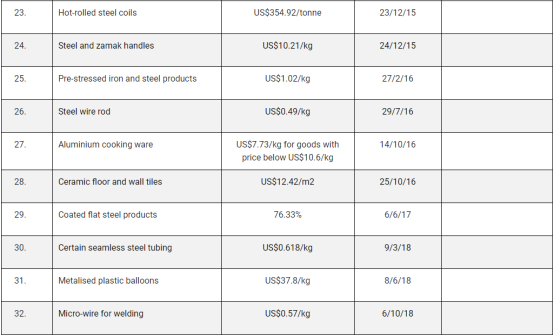

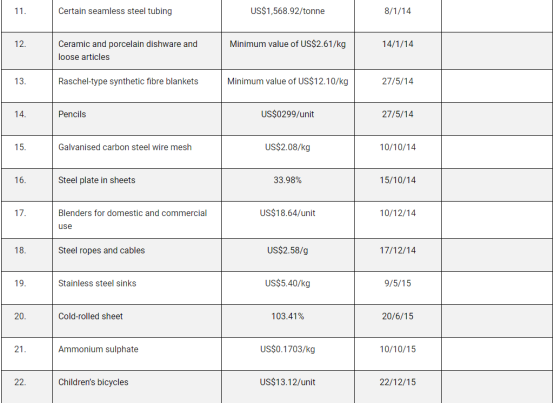

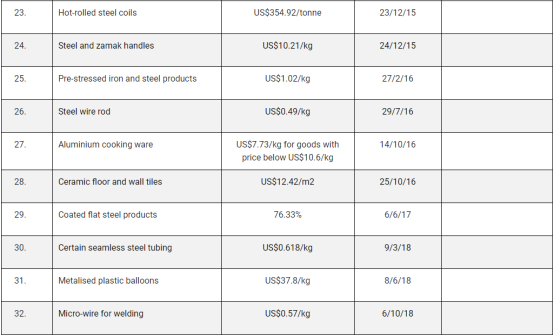

Anti-dumping duties on products from China :

(Data by HKTDC Research)

Colombia: Iron or steel products

Similar to Mexico politics, the Colombian authorities imposed a provisional tariff on imports of the merchandise in question from China. The tariff rate is ad valorem 35.90% of the FOB value for merchandise classified under subheading 7304.19.00.00 of the HS Code. The tariff rate is ad valorem 33.13% of the FOB value for merchandise under subheading 7306.19.00.00 of the HS Code.

Sources:

https://www.gob.pe/institucion/indecopi/noticias/596040-el-indecopi-modifica-antidumping-rights-to-chinese-footwear-for-the-benefit-of-la-produccion-nacional

http://wmsw.mofcom.gov.cn/wmsw/

https://research.hktdc.com/en/article/NDAwOTg3MzY3

Written by Victoria